Infini Course | Stablecoin vs. Credit Card: The Future of Business Payments in 2025

2025.12.09

The $120 Billion Friction Point

For the last half-century, the global economy has run on financial rails built in the 1960s. The "Four-Party Model" of credit card processing — involving the Merchant, Acquirer, Network, and Issuer — brought ubiquity to commerce, but it came at a staggering price.

In 2024 alone, businesses lost an estimated $120 billion to cross-border transaction fees, foreign exchange (FX) markups, and interchange levies.

We are now witnessing the "Great Payment Migration." 2025 marks the tipping point where major fintechs moved from experimenting with cryptocurrency to deploying it as essential enterprise infrastructure.

This is the transition from a "promise-to-pay" system (Credit Cards) to an "atomic settlement" system (Stablecoins).

The Core Comparison: Stablecoins vs. Credit Card Processing

To understand why Fortune 500 companies and agile startups are migrating to stablecoin rails, we must audit the inefficiencies of the incumbent system.

The Cost Equation: The 3% Tax vs. The 1.5% Cap

The Legacy Problem: Credit card processing fees are opaque and compounding. The "Merchant Discount Rate" (MDR) typically ranges from 1.5% to 3.5%. For cross-border B2B transactions, foreign exchange (FX) spreads can add another 2%, eroding margins in an era where efficiency is paramount.

The Stablecoin Efficiency: Stablecoins flatten the fee stack by removing the issuing bank and card network from the equation.

Stripe’s Model: Stripe now charges a flat 1.5% for stablecoin transactions.

On-Chain Costs: On Layer-2 networks like Polygon or Solana, the network ("gas") fee is often less than $0.01.

The Impact: For a business processing 50 Min international B2B payments, switching rails can result in 750,000 in annual EBITDA recovery.

Stablecoin vs Credit Card Comparison Infographic

Settlement Speed: T+3 vs. T+0

The Legacy Problem: Credit card networks operate on batch processing. Money captured on a Friday often sits in "clearing" limbo until Tuesday or Wednesday (T+3). This "float" traps working capital and forces businesses to rely on credit lines for liquidity.

The Stablecoin Solution: Stablecoins offer 24/7/365 settlement.

Atomic Settlement: Payment and settlement happen simultaneously.

Speed: Transactions on Solana settle in sub-seconds; Ethereum/Polygon in minutes.

Liquidity: Funds are immediately available for payroll, inventory, or treasury yield generation.

Risk Architecture: Pull vs. Push Payments

The Chargeback Dilemma: Credit cards utilize "Pull" mechanics, the merchant pulls funds using sensitive credentials. To protect consumers, the system allows chargebacks. "Friendly fraud" costs merchants billions annually.

Blockchain Finality: Stablecoins utilize "Push" mechanics, the customer pushes funds to the merchant.

Irreversibility: Once confirmed on-chain, the transaction is final.

Fraud Elimination: There is no mechanism for chargeback fraud.

Security: No sensitive data (PAN/CVV) is exchanged, eliminating the risk of data breaches at the merchant level.

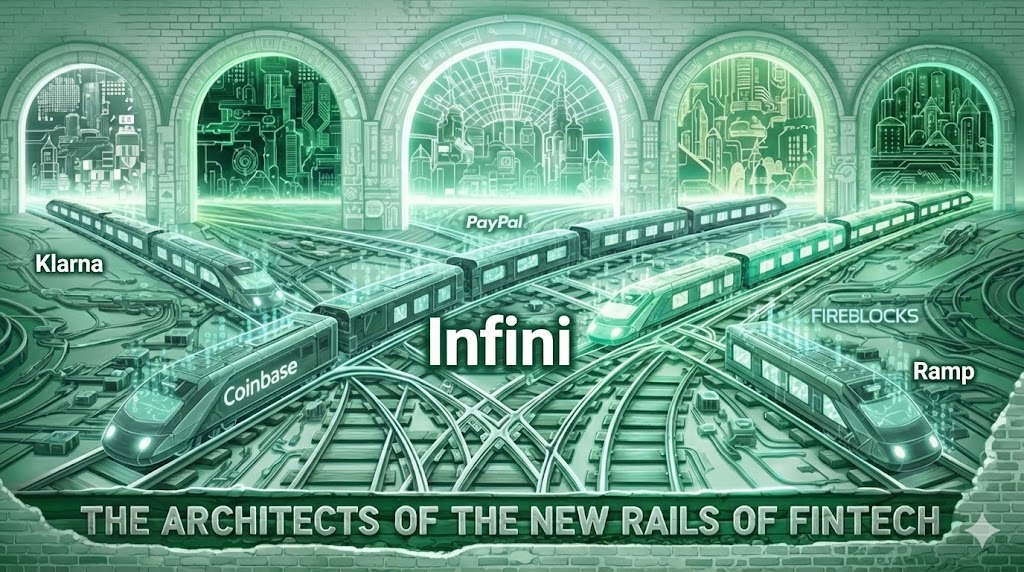

Industry Spotlights: The Architects of the New Payment Rails

The global migration toward stablecoin-based payments is being driven by both established fintech giants and crypto-native settlement networks. In late 2025, these companies are defining the standards for enterprise-grade blockchain payments.

Stripe: The Infrastructure Kingmaker

Stripe’s $1.1 billion acquisition of Bridge was the definitive signal that stablecoins are enterprise-grade. Stripe has pivoted to offer "Stablecoin-as-a-Service" (SCaaS), solving the complexity problem for merchants.

Open Issuance: Stripe's platform now allows enterprises to mint their own white-label stablecoins, handling the complex regulatory requirements of reserve management.

Merchant Acceptance: Through the Payment Element, merchants can seamlessly accept USDC on Ethereum, Solana, and Polygon. Stripe abstracts the blockchain complexity—merchants simply see a confirmed payment.

Settlement Flexibility: A critical feature for CFOs is the ability to settle in fiat. A merchant can accept USDC from a buyer in Brazil and have USD deposit into their bank account, with Stripe handling the conversion instantly.

Klarna: The Banking Pivot

Once known strictly for "Buy Now, Pay Later" (BNPL), Klarna has transformed into a stablecoin-native bank with the launch of KlarnaUSD.

Internal Settlement Strategy: Unlike consumer-facing crypto plays that often fail due to lack of adoption, Klarna is using stablecoins to solve its own problems first. It utilizes KlarnaUSD on the Tempo blockchain to settle debts between its global entities, bypassing SWIFT.

Strategic Insight: Klarna is proving that stablecoins are a backend optimization tool for banks as much as they are a consumer payment method. Public rollout is expected in 2026.

Coinbase Commerce: The Global Crypto Acquirer

Coinbase Commerce has matured into a global acceptance network for stablecoin payments.

USDC-First: Over 80% of volume settles through USDC.

Instant Global Liquidity: Accept in one region, settle in another—no correspondent banks needed.

Enterprise Controls: Audit trails, permissions, and compliance tooling are built-in.

Coinbase Commerce is the world’s leading “crypto acquiring” network.

Circle: The Settlement Network Behind USDC

Circle now operates a full programmable money network, not just a stablecoin.

Circle Accounts: Manage minting, redemption, and treasury functions without infrastructure overhead.

Cross-Border Settlement: USDC replaces SWIFT for many SaaS and marketplace platforms.

Programmable Wallets: Automate payouts, revenue shares, and refunds.

Circle is becoming a “USDC-powered global SWIFT.”

PayPal (PYUSD): Consumer-Scale Distribution

PYUSD is the most successful mass-market stablecoin rollout in history.

Network Reach: Integrated across PayPal, Venmo, and millions of merchants.

High Compliance Standards: A low-risk entry point for consumer stablecoin use.

Cross-Border Settlement: PayPal is piloting PYUSD for global merchant settlement to reduce FX leakage.

PayPal is driving consumer adoption at global scale.

Infini: The End-to-End Digital Currency Payment Stack

Infini has rapidly emerged as the leading all-in-one platform for stablecoin payment acquiring, global stablecoin payments, programmable invoicing, and treasury management. Designed for high-growth internet companies and multinational enterprises, Infini is positioning itself as the modern settlement layer for global businesses.

Stablecoin payment Acquiring: Infini enables merchants to accept USDC and other regulated digital currencies across Ethereum, Solana, and Layer-2 networks with enterprise-grade APIs. Funds settle instantly into a unified treasury dashboard, eliminating T+3 delays and cross-border losses.

Stablecoin Payments: Businesses can pay suppliers, employees, and partners worldwide in seconds. Infini handles compliance, address verification, chain routing, and liquidity so companies can operate a 24/7 global treasury without blockchain expertise.

Smart Invoicing: Infini converts cross-border billing into a programmable workflow: automatic invoice generation, stablecoin-denominated payments, FX reduction, and automated reconciliation. This reduces DSO and removes friction from international B2B commerce.

Yield & Treasury Management: Idle stablecoin balances can be allocated into compliant on-chain yield strategies. Companies can generate real-time yield on operational capital while maintaining liquidity, all within a regulated treasury environment.

Infini is becoming the enterprise operating system for global digital currency finance, combining payments, invoicing, and treasury into a single programmable platform.

Fireblocks: The Institutional Settlement Layer

Fireblocks provides the secure wallet and settlement infrastructure powering many fintech stablecoin deployments.

Bank-Grade MPC: Industry-standard secure custody.

Treasury Automation: 24/7 programmable fund flows.

Connected Ecosystem: Direct rails to exchanges, banks, and issuers.

Fireblocks is the silent backbone of institutional crypto finance.

Ramp: Global Fiat–Stablecoin Liquidity

Ramp is the leading on/off-ramp for regulated global stablecoin liquidity.

Instant Conversion: Fiat <-> USDC within seconds in 150+ countries.

Compliance Infrastructure: Local regulatory frameworks embedded.

Developer Tooling: Low-friction SDKs for deposits, withdrawals, and user onboarding.

Ramp provides the liquidity access layer that enables stablecoin commerce.

Worldpay (FIS): Card Networks Become Settlement Networks

Worldpay’s stablecoin pilots mark one of the earliest traditional acquirer transitions into blockchain settlement.

USDC Settlement: Merchants receive instant USDC payouts instead of waiting for clearing cycles.

Reduced FX Costs: Ideal for cross-border sellers.

Hybrid Model: Traditional rails + on-chain settlement options.

Worldpay is pioneering the blending of legacy payment rails with blockchain infrastructure.